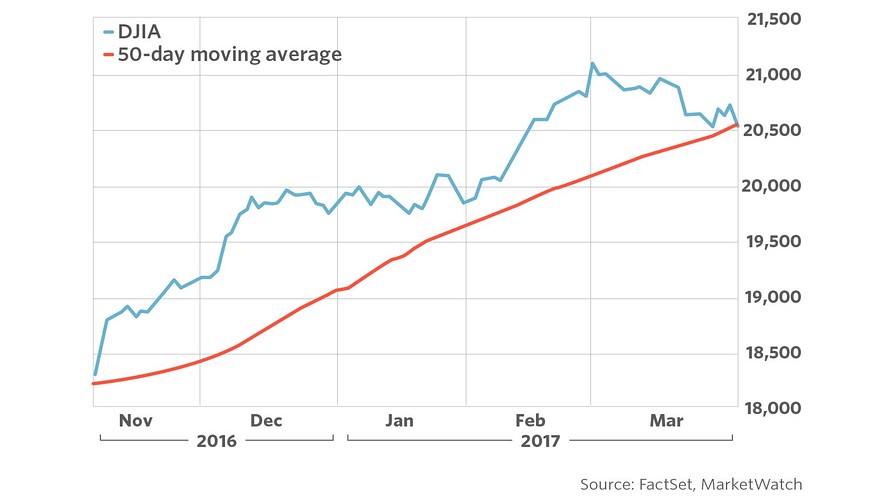

The Dow hasn’t closed below this important chart level since Election Day

In a sign that the stock market’s upward trend is losing steam, the Dow Jones Industrial Average temporarily broke below its 50-day moving average on Monday, a level that is often viewed as a measure of near-term momentum.

The Dow DJIA, -0.06% was at 20,606 in recent action, down 58 points, but had traded as low as 20,517.82 in earlier activity, below its 50-day average of 20,548.03.

The S&P 500 SPX, -0.16% was near its own 50-day moving average of 2,340.96, but hadn’t breached it as of midday. The S&P was down 0.4% at 2,353.22 in recent action.

If the Dow were to close below the technically significant level, it would represent the first time the blue-chip average has done so since Nov. 8—the day of the U.S. presidential election, when Donald Trump’s victory spurred a multimonth rally that took Wall Street to repeated records.

However, that upward momentum has shown signs of waning of late, with growing concerns over high valuations and growing doubts about the timing and scope of business-friendly legislation moving through Congress.

The Dow’s break below the 50-day average “is an indication that the market is in trouble. I’m fairly confident that we’re in a bull market correction, and if you’re a fund that is trying to allocate resources, you want to be in a market that’s trending higher,” said Walter Zimmermann, technical analyst at ICAP Technical Analysis.

“The 50-day moving average is a lagging indicator, suggesting the market peaked a few weeks ago. It doesn’t tell you where critical support comes in.” Zimmermann estimated that support would be 19,600 on the day, a level that is about 7.5% below the blue-chip average’s all-time high, which was reached on March 1.

Both the Dow and the S&P 500 dipped below their 50-day moving averages on March 27, though they subsequently rebounded to close above the level. The Nasdaq Composite Index, which has been a stronger performer of late thanks to gains in technology names, remains more than 1% above its own 50-day moving average.

Our social media links!